How to Become a Pilot in India? Know All Under One Umbrella

Many people are pretty inquisitive about the fact of how to become a pilot, and it is also the dream of many. However, just having a question in your

The thought of the cost of a plane might have crossed your mind someday, no matter whether you are a traveller or a pilot flying an aircraft. The Indian aviation market is growing rapidly, with record orders from IndiGo and Air India. If you are curious about the cost of a commercial aircraft, you have come to the right place.

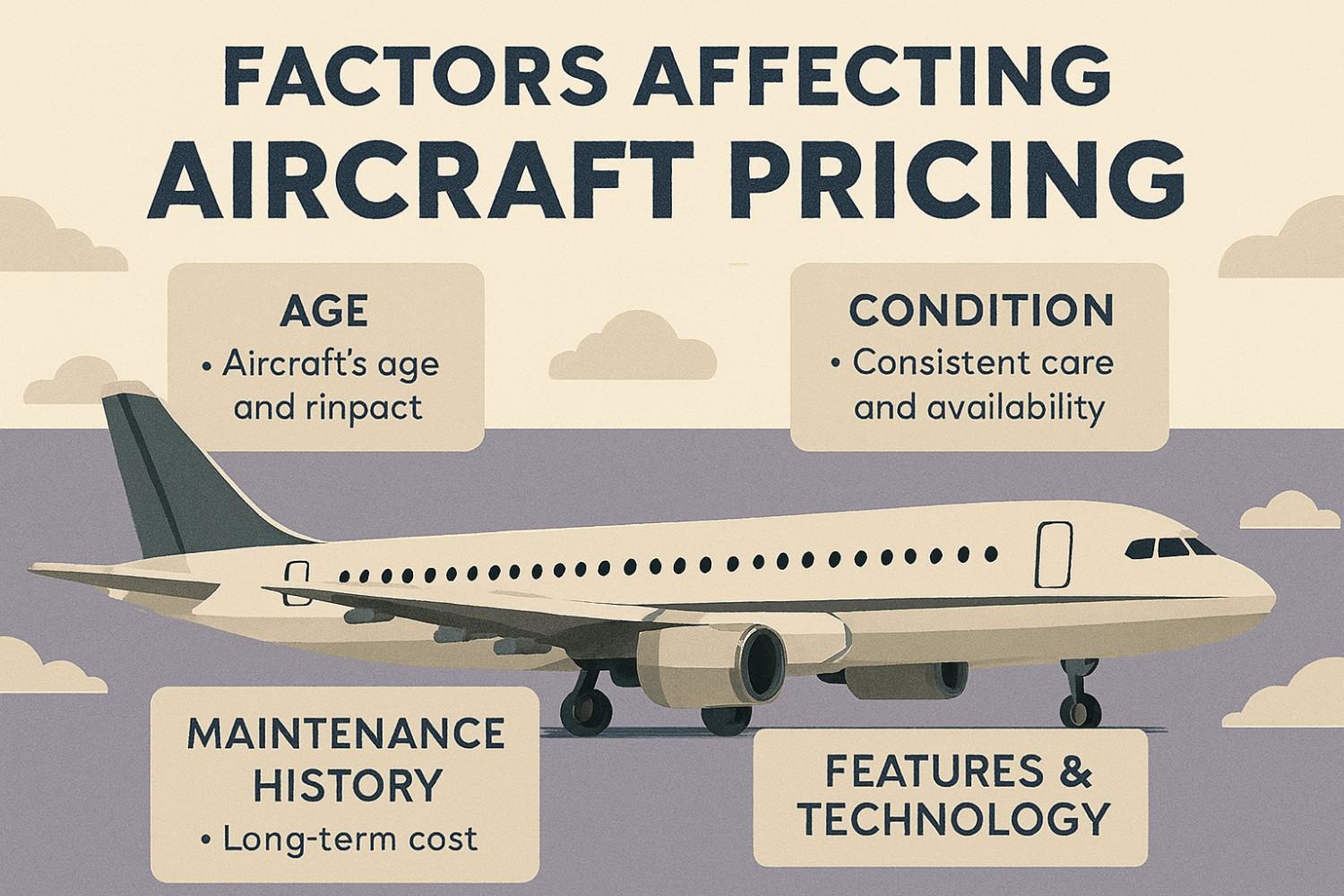

The cost of an aircraft is dependent on various factors like engines, weight/range of the aircraft, customizations, financing and leasing structures and delivery timelines. Airbus and Boeing do not publish official list prices after 2018 and it is often thought that the actual price is about half of the list price. Though what is the truth, we will find out?

India has the highest demand for single-aisle narrowbody aircraft. In 2023, IndiGo ordered 500 jets of the Airbus A320neo family, while Air India ordered about 470 aircraft from both Airbus and Boeing. The list price of these deals far exceeds the actual payout.

According to Airbus's list prices published in 2018, the list price of the A320neo was around USD 110.6 million, and the A321neo was USD 129.5 million, while the widebody A350-900 was USD 317.4 million. Boeing lists prices for the 737 MAX 8 at USD 117.1 million and the 787-9 at around USD 292.5 million.

The net price of a narrowbody can be USD 50–65 million and can fluctuate as per the configuration; widebody aircraft can range from USD 120–180 million.

The A320neo family and the 737 MAX family have the largest deployments on the Indian fleet. Looking at the 2018 public list prices, the A320neo and 737 MAX 8 have closely contested list prices, taking into account all the factors.

For Indian operations, the A321neo’s high-density and long-range capability provides non-stop connectivity to Middle East/South East Asia/Europe; Boeing 737-10 and 737-9 also cover similar segments. Where premium seating and high-range are a given, airlines opt for larger airframes to keep the cost per seat low.

Indian airlines are eyeing the Airbus A350-900/1000 and Boeing 787-8/9/10 and 777X for long-haul. The A350-900 were listed at USD 317.4 million in 2018, and the 787-9 at about USD 292.5 million; the actual net price depends on discounts and specifications. Widebodies often have fewer discounts than narrowbodies due to high demand, production-rate limitations and a shortage of delivery slots.

Any foreign aircraft deal in India is usually priced in US dollars. Hence, USD/INR exchange-rate fluctuations directly impact the net cost. Rupee was about INR 87–88 per dollar around August 2025; hence, a USD 50–60 million narrowbody works out to be around INR 435–528 crore. A widebody for USD 150 million =INR 1,305 crore. This is also a significant factor in driving the cost of long delivery timelines.

Most airlines in India operate aircraft on operating leases, which reduces initial capital expenditure and allows fleet flexibility. Market conditions impact lease rates; For instance, monthly lease rates for mid-life 737-800/A320-series are around USD 230–250 thousand. It is higher for new-delivery narrowbodies and can go up to several million dollars per month for widebodies.

Tax/duty incentives are offered to promote the aircraft-leasing ecosystem through GIFT City, thereby reducing leasing costs and strengthening the domestic financing channel.

The engine of any aeroplane is a major part of the cost. In the narrowbody segment, maintenance and “power-by-the-hour” contracts for CFM LEAP and Pratt & Whitney PW1100G decree multi-year costs.

Turboprops such as the ATR 72-600 are popular for regional connectivity (UDAN) in India. The list price of an ATR 72-600 is reported to be around USD 26–27 million, and is typically discounted. Second-hand market prices have been seen to be as high as USD 10–20 million, depending on the age/hours/maintenance status of the vehicle.

Market prices for models such as the second-hand A320ceo/737-800 depend on availability, age, maintenance record and demand-supply cycles. Second-hand values and lease rates have seen upward trends when demand for narrowbodies is high.

Tax-Structure: Import duties, GST treatment, IFSC-specific exemptions and double-tax avoidance agreements influence the net price.

The generalized picture, given Indian airline-level large orders and recent industry trends, is:

Narrowbody A320neo/737 MAX: USD 50–65 million (₹435–565 crores, ₹≈87/$)

Widebody A350/787: USD 120–180+ million (₹1,040–1,565 crores)

This question does not demand a “one-line” answer, because the economy encompasses not only the purchase price but also lifecycle economics. Indian airlines choose A320neo vs 737 MAX 8 or A321neo vs 737-9/-10 based on actual route-map and fleet-commonality.

As an approximation, the net price of a narrowbody A320neo/737 MAX in India can be between ₹435–565 crores, across multiple deals and a widebody A350/787 can cost around 1,040–1,565 crores. But that’s just an approximation; the actual cost includes delivery slots, engine/maintenance packages, customization, financing/leasing, exchange rates and policy frameworks.

If you want to fly those expensive planes, you need to get trained for them. For this, you can enroll in a top-notch flight training school such as Flapone Aviation. Here, you will gain familiarity with flying aircraft and receive a great practical experience. So, what are you waiting for? Join us now.

Whether you're aiming to be a pilot or aviation expert, we’re here to help you choose the right aviation path.