It is Time to Focus on Human Capital for the Indian Aviation Industry

With IndiGo, India’s largest carrier, going into an operational meltdown in December 2025, the focus shifted to pilots, ground staff and jus

India is on the way to growth and the rising middle class is a result of that. Of the country's total population, approximately 38% is middle class. As the economy grows and purchasing power rises, how people travel is changing. More people are choosing air travel for faster, more convenient travel. As demand for air travel increases, the fleet will also grow, as Airbus projects for India.

Now,

let us see what the leading airline company predicts for India.

According to Airbus, India’s commercial aircraft fleet will

nearly triple to about 2,200 planes in the next ten years, reinforced by rapid

traffic growth, airport development and growing airline capacity, Jürgen

Westermeier, president and MD, Airbus India and South Asia, said at Wings India

2026 in Hyderabad. India is an important market for Airbus, where we deliver

over 10% of our annual production, and this share is expected to grow.

India currently operates about 850 commercial aircraft. According to Airbus’s India market outlook, passenger traffic will grow at about 9% annually over the next 10 years, with trips per capita increasing from about 0.13 today to roughly 0.29 by 2035. India is currently the third-largest, having risen within 10 years. Annual originating passenger trips will reach about 400 million over the period.

Indian airlines have over 1,700 aircraft on backlog, with roughly 72% of those orders placed with Airbus. Airbus alone has around 1,250 aircraft on order from Indian customers for delivery over the next decade.

Right now, the company has 1,250 aircraft on order for the next 10 years. The calculations are relatively straightforward. On average, about 120 Airbus aircraft will arrive in India each year. The airline will peak at about 150 aircraft in a single year, representing the maximum delivery volume. India is Airbus’s fastest-growing national market by demand. Developed countries like the US and Europe are in replacement cycles, not growth cycles anymore.

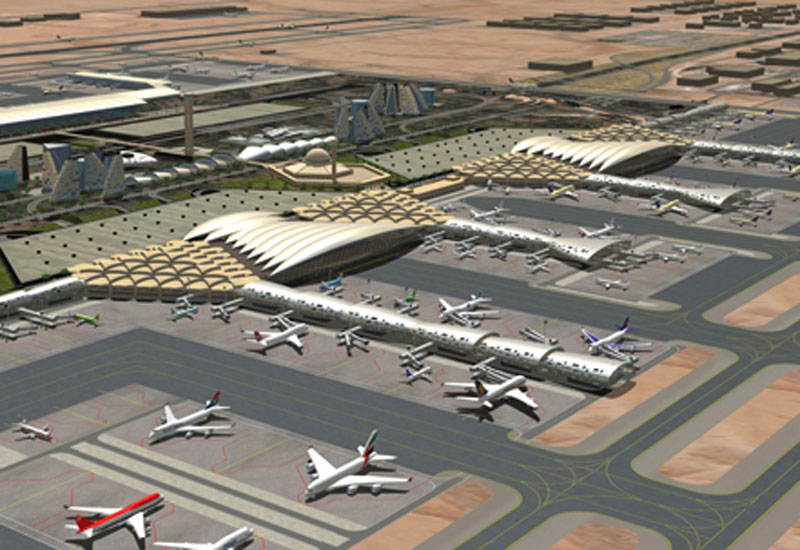

Airbus expects the number of operational airports in India to rise from about 150 today to around 200 within a decade, alongside continued government-led infrastructure investment. Fleet growth will also be accompanied by a shift toward larger aircraft, such as the higher-capacity narrowbodies and more widebody jets, which will increase the total passenger seat capacity faster than fleet growth. Air cargo capacity of Indian carriers will also more than triple over the same period, reaching above 5,000 kilotonnes annually.

India’s maintenance, repair, and overhaul (MRO) market will grow to USD 9.5 billion over the next 10 years, up from about USD 3 billion at present, driven by fleet expansion and aircraft ageing.

Heavy maintenance demand will also increase threefold owing to the high volume of aircraft inductions. India already has base maintenance capacity serving domestic and neighbouring markets, with other investments and airline-led facilities under development. Airbus is supporting local MRO players with training, tooling, materials and consulting partnerships.

According to Airbus, Indian airlines will invest more in digital tools and predictive maintenance systems over the next 10 years as flight operations become more complex.

According to Airbus estimates, India will need about 35,000 pilots and 34,000 technicians by 2035, roughly 3X more than the current workforce levels, to support the expanded fleet. Training will grow more than two-fold in the next ten years. India currently has more than 40 flying schools, over 50 basic maintenance training schools and over 30 full-flight simulators, but additional training capacity will be required. Airbus has pilot and maintenance training services in India and has joint training partnerships with airline and airport groups for simulator and type training.

The company's sourcing model has evolved from engineering and digital services to intricate aerostructure manufacturing and final assembly. Indian suppliers have industrialized production of over 7,000 aircraft parts, including A220 aircraft doors and structural beams. Almost all Airbus aircraft have India-made parts or engineering input.

Airbus is beginning final assembly of H125 helicopters in Karnataka, with the line scheduled to be inaugurated in March 2026 and will deliver the first India-assembled C295 aircraft in the third quarter of 2026. Together, these assembly lines will support around 10,000 jobs in the aviation sector.

With the growth in the number of aircraft, the demand for commercial pilots will also increase, which is exactly what we expect in the next ten years, according to Airbus's projections. Commercial pilot jobs will increase, so you need to be ready to seize the opportunity. We at FlapOne Aviation believe in developing the best pilots and if you want to be the best, join us without further delay.

Connect with our aviation mentors to find the right path toward becoming a licensed aircraft pilot.